RAKBANK marks milestone with its first Central Bank Digital Currency transfer via mBridge

RAKBANK has become one of the first banks in the UAE to execute a cross-border Central Bank Digital Currency (CBDC) payment using mBridge. The trade, facilitated through CBUAE’s innovative mBridge platform, instantaneously transferred Digital Dirham against digital Chinese Yuan. This initiative positions RAKBANK at the forefront of digital banking transformation and is a landmark transaction, marking a significant leap forward in real-time, transparent, and cost-effective international payments.

Dubai, United Arab Emirates, September 10, 2024 – The National Bank of Ras Al Khaimah (“RAKBANK”) announced today that it is one of the first banks in the United Arab Emirates to successfully execute an international remittance using China’s digital Yuan (eCNY) in exchange for the Digital Dirham, the UAE’s CBDC. This transaction highlights the transformative potential of Central Bank Digital Currencies (CBDCs) in revolutionizing cross-border payments by delivering in real-time with enhanced transparency, and reduced costs. RAKBANK becomes one of the first banks globally to be part of a live CBDC platform and is ready to transact.

Understanding Project mBridge

Project mBridge is an ambitious initiative aimed at addressing inefficiencies in cross-border payments, such as high costs, slow processing times, and operational complexities. Launched in 2021, it is a collaborative effort between the Central Bank of the United Arab Emirates (CBUAE), the BIS Innovation Hub, the Bank of Thailand, the Digital Currency Institute of the People's Bank of China, and the Hong Kong Monetary Authority.

The core of mBridge is a multi-central bank digital currency platform, built on distributed ledger technology (DLT). This platform allows participating central and commercial banks to conduct real-time, peer-to-peer cross-border payments and foreign exchange transactions. The mBridge Ledger, a new blockchain, underpins the platform, supporting secure and instantaneous transactions.

The landmark transaction by RAKBANK not only highlights the bank’s cutting-edge digital capabilities but also marks a significant step forward in the global financial landscape.

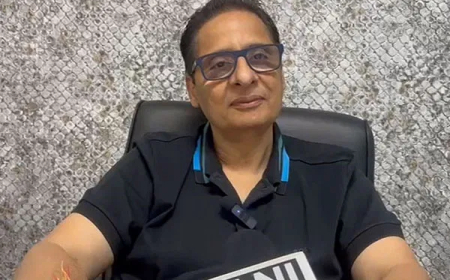

Raheel Ahmed, Group CEO of RAKBANK, commented: “The participation of RAKBANK in the mBridge platform and the execution of our first-ever central bank digital currency international payment highlight RAKBANK’s cutting-edge digital capabilities. This milestone reflects our commitment to breaking boundaries and solidifying our position as a leading retail and commercial bank in the UAE, with a rapidly expanding international payments arm”.

Vikas Suri, Co-Head of Wholesale Banking Group at RAKBANK, added, “The successful transfer of eCNY to our correspondent in China is a game-changer in several respects. It’s one of the first UAE-led foreign currency transfers executed in local currencies without involving a third currency to China and without using conventional payment rails. This is a gamechanger that paves the way for instant blockchain based CBDC exchanges with payment versus payment, fundamentally altering how we approach international payments. Our next steps will focus on supporting the China and UAE business corridor for our clients, by leveraging mBridge to reduce costs and improve the speed of remittances.”