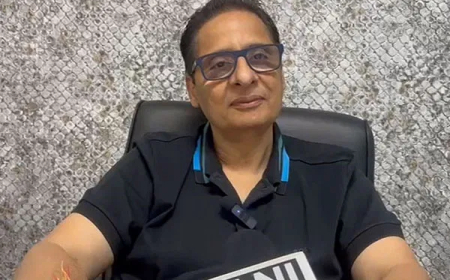

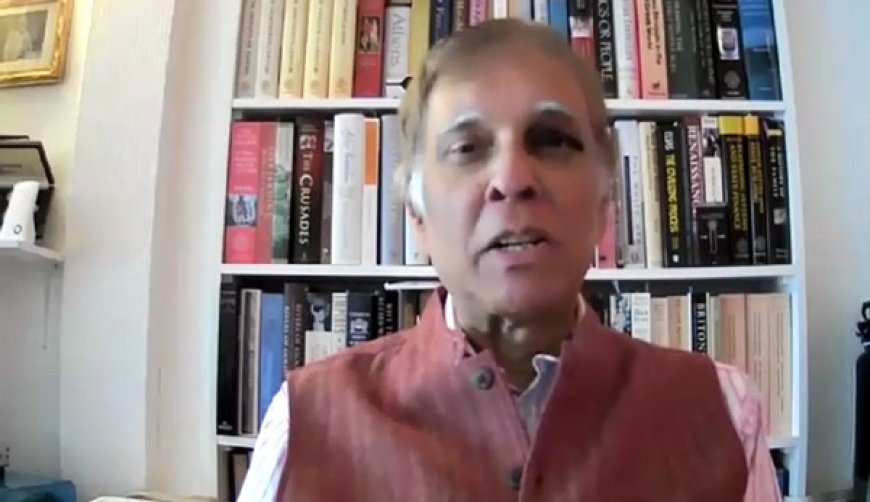

Economics Pundit Gautam Sen: India’s Wealth Tax Will Scare Off Indian Businessmen to Dubai

The expert in his field and published author cautions against India’s self-defeatist tax scheme.

Indian Finance Minister Nirmala Sitharaman might be prone to chest-thumping where her ambitious schemes are concerned. But political economist and author Gautam Sen warns of a possible self-goal, especially with regard to the hefty Wealth and Inheirtance Tax in India. India may be the world’s 5th largest economy, but Prime Minister Narendra Modi’s ambitions to make it to the Top Three largely dependents on supporting the country’s industrial captains. However, droves of India’s billionaire businessmen are searching for more tax-friendly shores... not least of all, that of Dubai.

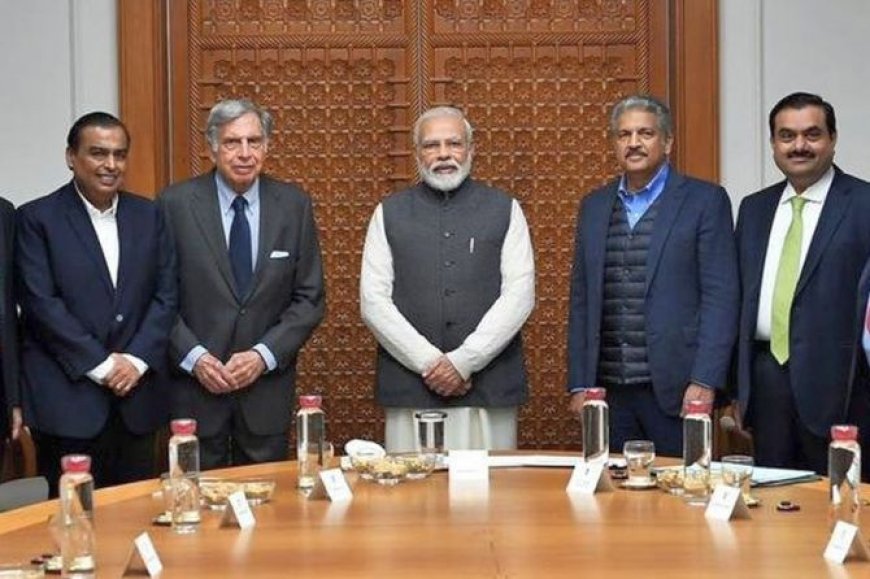

Sen has noted that as much as 70% of these émigrés have headed to this Middle Eastern hub, primarily due to the fact that the emirate doesn’t even levy Income Tax on local businesses. Sen believes that this trend will continue unabated unless the Indian government quickly establishes tax holidays and other incentives for the industrial high and mighty. “The very rich”, Sen told the Mint news website, “- that is the Ambanis, the Andanis, the Mahindras, the Tatas and I presume not more than 500 (of) the billionaire class, will emigrate from India to Dubai.”

Sen espouses his prediction by pointing to Sweden. He states that the heavy tax structure of this prosperous EU member backfired due to several local firms shifting base to tax haven nations. Sen further adds that even the owner of Sweden’s top-earning company IKEA – Ingvar Kamprad - was compelled to flee his home nation, resulting in the government having to revise its harsh taxation policies.

Sen also questions the practicality of Income Tax in India, elucidating the fact that a large percentage of Indian citizens don’t even pay it. This, while they successfully dodge conviction and fines for the transgression. Sen also states that most of the Indian citizens’ wealth is in their residences and the government needs to survey and take stock of these private assets in order to levy taxes accordingly.

In rebuffing Congress leader Rahul Gandhi’s suggestion of wealth-distribution, Sen adds that most of the top bracket’s wealth is invested in businesses, which would have to be liquidated if the funds are to be shared evenly. All these are valid claims by Mr. Gautam Sen, someone who could function well as a consultant to Mrs. Sitharaman... if only she would have the prudence to accord him her ear.